Lawmakers reacted to the need for more transparency, predictability and clarity in pension schemes and implemented the Digital Pension Overview in Germany.

The objective is to give citizens a complete, comprehensible, reliable and comparable overview of their expected retirement income through an electronic portal. The portal (Digital Pension Overview) can be used voluntarily and free of charge.The Central Department for Digital Pension Overview (ZfDR) is responsible for the establishment and operation of the Digital Pension Overview. In order to have to access to a functional organization and infrastructure as quickly as possible, the ZfDR was attached to the German Pension Insurance. Accordingly, the ZfDR began their work immediately once the law came into effect and will fill the Digital Pension Overview with life over the next months.

Process - usage of the Digital Pension Overview

- In order to receive a Digital Pension Overview, residents must request this through the ZfDR portal.

- The ZfDR will then request the existing data about pension scheme contracts from the affiliated pension scheme institutions. The ZfDR and the pension scheme institutions will use the tax ID for identification purposes.

- The pension scheme institutions in turn will transfer the data about existing pension scheme contracts to the ZfDR, where they will be prepared into a digital pension overview for the respective resident.

- The goal is to put together the existing data in such a way that a complete and clear summary of all pension scheme claims can be provided.

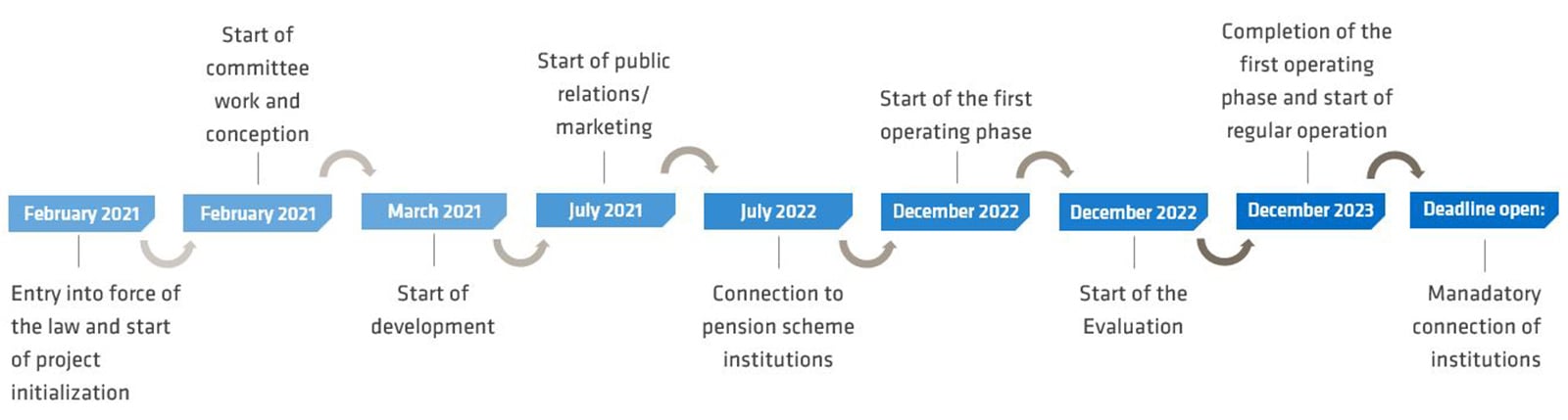

Ambitious timetable

The ZfDR is preparing for the first phase of operation of the Digital Pension Overview until December 2022. Based on a twelve-month test and evaluation phase, pension scheme institutions can initially participate voluntarily, until a mandatory affiliation of the respective institutions, planned for the beginning of 2024, when they will be legally obligated to provide at least annual reports.

Committee structure

In the future, the ZfDR, in agreement with a central control body consisting of representatives from the three pillars of the pension system, the Ministries for Employment and Social Affairs or Finances as well as Consumer Protection, will decide upon important design questions for the Digital Pension Overview.

The decisions to be made by the control body will be prepared by the ZfDR in cooperation with the so-called advisory boards provided for by the legislation. The advisory boards are to ensure integration of a wide range of expertise.

Advisory boardsThe first advisory board “Financial Mathematics / Technical Data set” will initially deal with actuarial topics relating to the data and values to be reported to the ZfDR by the pension institutions. Later, it will also take on topics such as comparability and aggregation of different pension benefits.

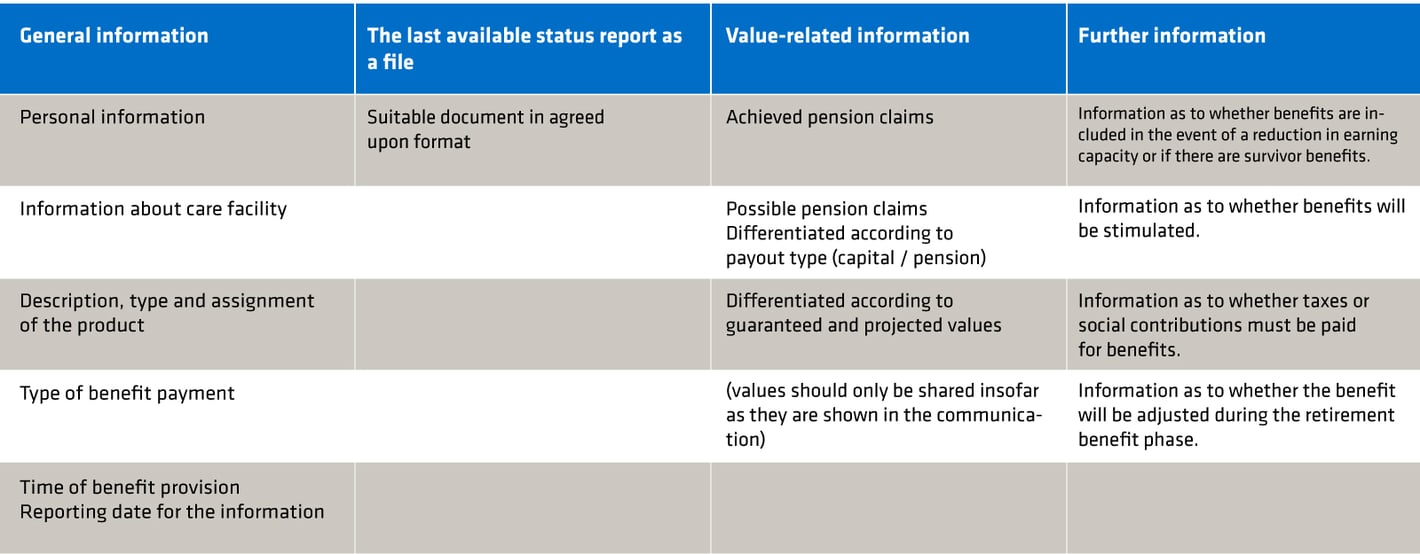

Current status of the scope of information for the technical data set:

The second advisory board deals with the data set and the technical interfaces. Furthermore, the corresponding reporting processes are defined and will be continued in a suitable manner in the future.

The scientific accompaniment of the project and the continual evaluation of the effectiveness and clarity of the Digital Pension Overview as well as the quality of the information are reserved for the third advisory board.

The fourth and fifth advisory boards will deal in particular with the topics of communication and the design of the portal solution as the project progresses further.

Conclusion

Digital aids give us a quick overview in many areas of our daily life - however, in pension schemes, many different status updates are still primarily done in paper. That is why the Digital Pension Overview is long overdue and we at adesso welcome the fact that this project is gaining momentum.

It is very satisfying that one of the adesso managing directors, Dr. Michael Höhnerbach, is providing his technical and personal contribution as a member of the Technical Interfaces advisory board to successfully design the Digital Pension Overview project.

Do you want to find out more about our solutions in the area of company pension schemes and communication with authorities for insurance companies? Then feel free to contact our expert Senthuran Sabaratnam.