This article provides a brief overview of the contents of the recent cabinet decision to introduce online pension accounts, as well as the challenges and solutions for companies and for the German Pension Insurance Scheme.

So, what exactly is this all about?

On August 26, 2020 the cabinet decided to introduce online pension accounts. This decision clears the way for adoption by the German Bundestag (the national Parliament of the Federal Republic of Germany). In the future, all German citizens will be able use their online pension accounts to obtain an overview of the status of their pension at the touch of a button. In addition to the state old-age pension, the overview will also include the status of other pension contracts. The entire system will be set up with an organization affiliated with the German Pension Insurance Scheme, and an electronic query will be conducted and the overview will be delivered to citizens in digital form.

What began in 2002 with the annual pension information that was sent out and which only covered the state pension insurance, is now being continued as a general and digital overview that includes all three pillars the old-age pension (statutory, company and private old-age pension). Basically, then, this is a modern digital and mobile way to provide information to citizens that can help raise their awareness of the subject of pensions by means of offering a comprehensive overview.

What needs to be done after the legislation is passed?

Companies that offer old-age pension products can initially decide to make the figures from the annual overview available for viewing via the online pension account. Twenty-one months after the law enters into effect, selected companies will be included in the online pension account's initial operating phase. In a later phase, pension institutions will be required to connect to the online pension account. The existing picture of the available pensions for individuals will thus gradually become more complete.

Companies that offer old-age pension products, such as insurance companies, pension and support funds and pension funds, will have to integrate an appropriate interface in order to be able to automatically transfer the old-age pension data to the online pension account at the moment when the citizen accesses it.

This new interface will be integrated into our in|sure GovInterface reporting system when the online pension accounts enter into effect. In this interface, the digital annual reports of the individual pension schemes will be automatically transmitted to the online pension account, which will then compile and display an overview of these reports.

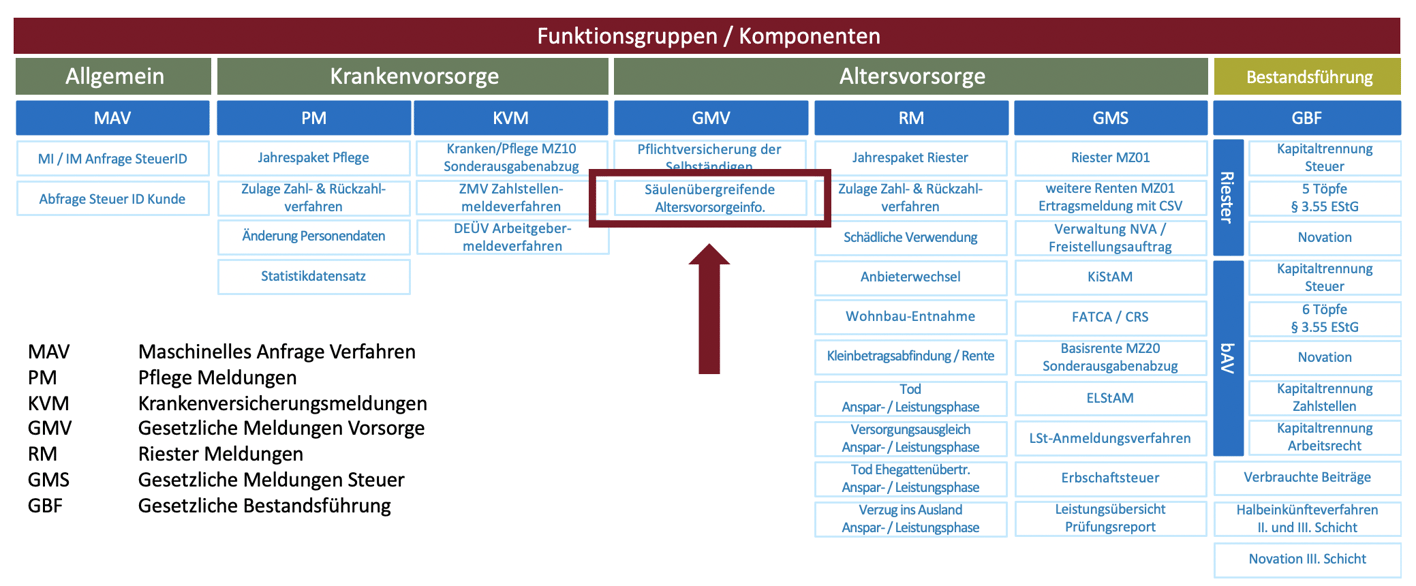

The new "cross-pillar old-age pension information" interface within our in|sure GovInterface reporting system. (Graphic: Overview of functional groups and components of the statutory reporting procedure)

The new "cross-pillar old-age pension information" interface within our in|sure GovInterface reporting system. (Graphic: Overview of functional groups and components of the statutory reporting procedure)

The challenge for the German Pension Insurance Scheme will be to integrate the online pension account into the existing digital services and, in addition to providing access to the currently available information on the state old-age pension, to implement a mechanism with the following features:

- A link from the German Pension Insurance Scheme website to the yet-to-be-established central office's Internet domain for a digital overview of the pension.

- Accessing and illustrating each user's online pension account, i.e. automatic display of all old-age pension information from the providers with whom the user has an existing old-age pension contract.

- The provision of additional functions for printing the pension plan status (generating a pdf file) and for downloading the contract overview (for example, as .csv file).

This will inevitably involve the use of modern technologies that can offer attractive access to the subject of old-age pensions, especially to those generations that are still only halfway through their working lives or are just starting out and therefore have enough time until retirement to make proactive, long-term provisions for their old-age pension.

adesso insurance solutions and our parent company, adesso SE, have the necessary expertise to actively participate in designing the complete solution.

If your company would like to know more about our smart IT solution for the integration for communicating with the authorities about contracts, we would be pleased to present our solution to you. You can make an appointment directly with us here.