The fact that markets are constantly changing is nothing new. Nevertheless, the individual participants are subject to new challenges again and again. Insurance companies also need a new direction, for example, due to lower revenues in life and private health insurance. Composite insurance is currently benefiting from this change. With its many divisions, it is one of the most complex insurances in the industry, which in turn makes the challenges even more complex.

Germany is on a respected course regarding insurance. That means it is time to hold the reins and actively cooperate in the development of the international insurance market. The path to this goal is actually simple: you find out what the current status is, what has changed and how insurance companies can benefit from this development.

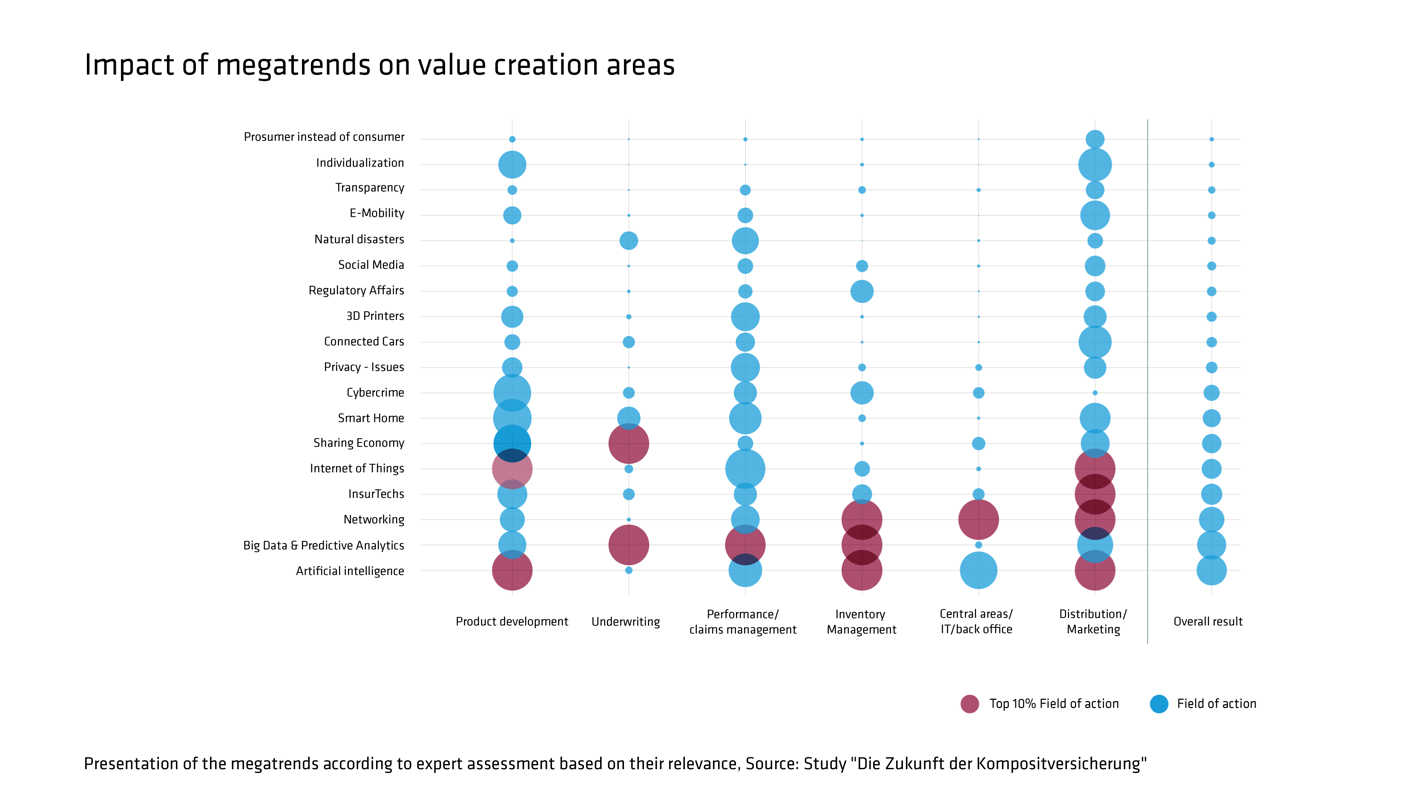

Together with Versicherungsforen Leipzig, adesso insurance solutions dedicated themselves specifically to this task with the current study regarding "The future of composite insurance": The study comprehensively deals with mega trends and examines their effects on individual sections of the value-added chain from composite insurance companies. Initially, the largest fields of action were identified and filled with life through the listing of theses. These theses served as a basis for discussion for decision-makers from top management. Finally, the status quo of the industry was determined through a survey of 180 representatives from the industry. Using this basis, the study does not only show the current status of composite insurances, but rather also provides practical recommendations for the future.

An overview of the central results:

Insurance companies will simply keep their individual product opportunities in the future or develop individual tariffs using artificial intelligence. A proper IT connection is required to guarantee data retention.

In order for the IT to in turn better support product management and the other areas of the value-added chain, agile project teams positioned locally within the insurance company should be formed in the future.

Underwriting is gaining more and more importance as support specifically for product development. This will develop into an industry-wide, customer-centered method of thinking and also promote sales. Predictive Analytics and the real-time evaluation of unstructured data can support the control of the underwriting process.

The topic of "Data" also plays an important role for long-term customer retention. Keeping existing customer data up to date and analyzing this data will help to detect cross-selling and up-selling potentials quicker.

Several changes are visible through this technologization. On the one hand, existing risk positions move, which leads to new questions of liability. Since the entire process including fraud detection will run automatically in the future, however, this helps to prevent damage.

Future trends have a particularly strong effect on the areas of marketing and sales. The role of the sales partner is changing into that of a "coach" for customers who want to give up their responsibility for making decisions. In other cases, the use of digital assistants will increase particularly for consultation and for taking care of damage claims.

Altogether, the study shows the quick rise of data quantities and how important cooperations with other companies are in order to save money and to be able to act quicker.